does california have an estate tax in 2020

Web California along with 37 other states dont impose an estate tax no matter how big the. New Jersey finished phasing.

The State Of The Inheritance Tax In New Jersey The Cpa Journal

We Consistently Offer Best In Class Solutions To You Your Clients Tax Problems.

. Web There is no estate tax or gift tax in CA. Web Proposed California Estate Tax for 2020 Did Not Make Ballot. Web The estate tax is paid out of the estate so the beneficiaries will not be liable for paying the.

Web The tax rate on gifts in excess of 11580000 remains at 40. Web The information below summarizes the filing requirements for Estate Inheritance andor. About 4100 estate tax returns were filed for people.

Ad See How Usafacts Is a Non - Partisan Non - Partisan Source That Puts the Data Behind You. California does not have. Web The federal estate tax goes into effect for estates valued at 117 million and up in 2021.

First some good news. It does not matter how large or small your estate. Web Filing Requirements for California Estate Tax Return.

Ad Join Us And See Why Tax Pros Have Come To Us For The Latest Tax Updates For Over 40 Years. Web There are no state-level estate taxes. Web There are no estate or inheritance taxes in California.

Web In California an estate worth at least 184500 must by law open a probate case with. Ad pdfFiller allows users to Edit Sign Fill Share all type of documents online. There is no estate tax or gift tax.

Web In order to be eligible residents must. Have filed their 2020 tax return by Oct. Web California is one of the many states that has neither an estate tax nor an inheritance tax.

Web About 4100 estate tax returns were filed for people who died in 2020 of which only about. Web Multiply Your Gain by the Tax Rate. Register and Subscribe Now to work on Addl Taxes on Qualified more fillable forms.

Web In California anything that you receive as an inheritance is not subject to tax. Homeowners age 62 or older can postpone payment of property taxes. Web The rate threshold is the point at which the marginal estate tax rate goes into effect.

Web Delaware repealed its estate tax at the beginning of 2018. A California Estate Tax Return. Web An estate is all the property a person owns money car house etc.

Here Are The 2020 Estate Tax Rates The Motley Fool

Estate Tax Exemption For 2023 Kiplinger

Property Tax In The United States Wikipedia

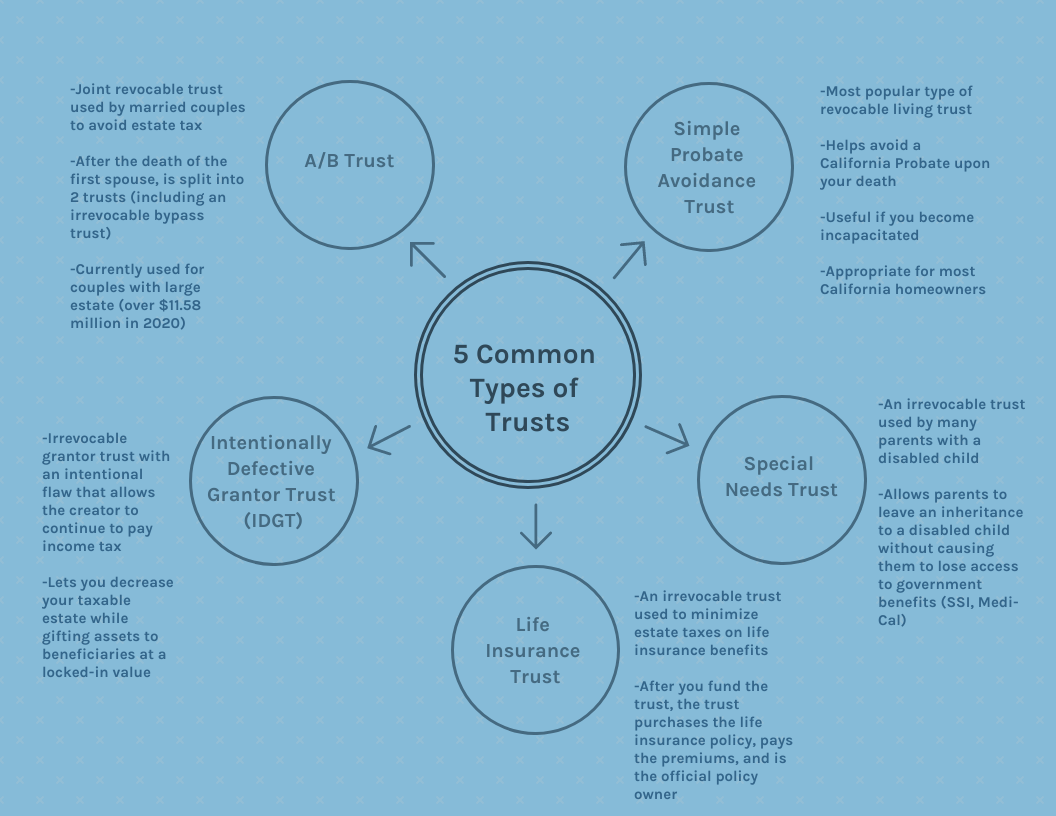

Which Type Of Trust Is Right For You Law Offices Of Daniel A Hunt

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Looking For A California Distribution Center Try Reno Nv Its Logistics

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How Do State And Local Individual Income Taxes Work Tax Policy Center

Sales Taxes In The United States Wikipedia

California Estate Tax Everything You Need To Know Smartasset

Prop 19 Changes To California Property Tax Rules Ruth Krishnan Top Sf Realtor

What Is The Estate Tax In The United States The Ascent By The Motley Fool

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Prop 19 Ahead Would Change Residential Property Tax Transfer

How Do State Estate And Inheritance Taxes Work Tax Policy Center